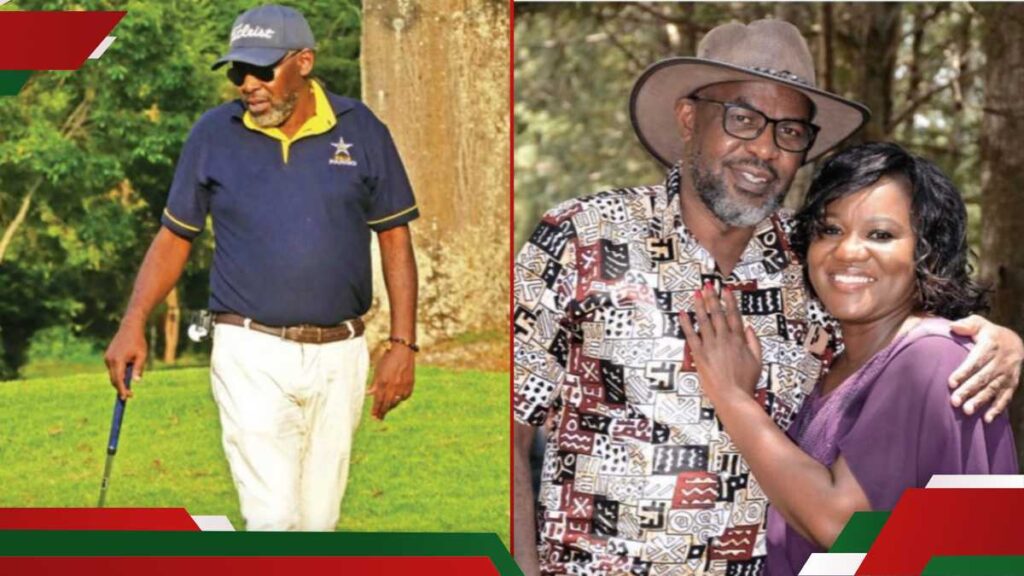

With hours to the reading of the 2025 Finance Bill, Githunguri Member of Parliament Gathoni Wamuchomba has weighed in on what Kenyans should expect, warning that the proposed law could place a heavier burden on both companies and ordinary citizens.

Speaking on Spice FM on Wednesday, Wamuchomba criticised Treasury Cabinet Secretary John Mbadi, accusing him of misleading the public about the Bill’s impact.

“This Finance Bill does not favour hustlers. Every time I speak out like this, the so‑called government billionaires call me and tell me to stop ‘misleading the people.’ But if I am truly misleading anyone, let them come here tomorrow and answer these questions,” she said.

The lawmaker argued that, unlike the last year’s Finance Bill, which directly targeted the end-user, the 2025 Finance Bill places the tax burden on companies and manufacturers, an impact she says will ultimately be transferred to employees and consumers.

“This finance bill is worse than last year’s. It’s just that it’s not easily understood, as the changes are hidden in other laws. The ordinary mwananchi will not see it coming.”

Increased costs for manufacturers

According to Wamuchomba, the Bill also introduces new tax burdens for manufacturers, including increased compliance costs tied to stricter reporting requirements and automated suspension mechanisms.

“If someone works at a company, they were previously exempted from certain taxes, but now those taxes have been reinstated. It means the employer and manufacturer will be required to pay the tax, and this will be reflected in employees’ paychecks.”

The Bill also proposes changes that may increase production costs, discourage investment, and complicate compliance processes. For instance, a proposed VAT exemption on packaging bags for tea and coffee may render input VAT non-recoverable for local manufacturers. It also limits the ability to carry forward tax losses.

Another notable provision in the Bill is the proposed tax exemption for imported eggs, onions, potatoes, and plastics.

The MP argues that the move will favour imports over locally produced goods, which still attract taxes on inputs like animal feeds. “Imported products will become cheaper, while local goods will be more expensive due to production taxes that have not been removed,” she said.

She also raised concerns over widening digital taxation under the amendments.

“They’re not just taxing any digital service. They are taxing all financial transactions conducted over the internet, mobile banking, paying for huduma centre services, YouTube, and online classes. If you use the internet to pay, you’re captured in these new taxes.”

Stay informed. Subscribe to our newsletter

Wamuchomba further added that the government plans to impose a tax on all software used in Kenya and has introduced a five percent withholding tax for content creators.

While the digital asset tax is set to reduce from 3 percent to 1.5 percent. She claims the broader digital economy is being targeted under amendments to the Excise Duty Act, the Tax Procedures Act, and the Income Tax Act.

“Content creation, streaming services, online subscriptions, e-learning—anything on a digital platform is being taxed.”

Another proposal is the increased powers for the Kenya Revenue Authority (KRA) through expanded electronic tax receipt requirements.

“Every electronic tax invoice will now be integrated with KRA systems. The Commission is being given the authority to reassess your business.

This is not just about income tax, it’s about every amount coming in and going out. KRA can come directly into your business and scrutinise your records. This opens the door to possible misuse,” Wamuchomba stated.

Changes to the tax relief structure

Another highlighted proposed changes to how tax relief is applied, noting that if relief is only deducted before computing taxable income, rather than offset against tax payable as the law currently states, the net income for employees could decrease significantly.

This change may not be apparent to most Kenyans, but it would result in increased PAYE contributions, reducing disposable income, particularly for low- and middle-income earners.

“Despite appearances, this will lower net income. While it may seem taxpayer-friendly on the surface, it actually reduces employees’ purchasing power,” she said.

“The government says there are no new taxes, but the structure has been quietly altered to collect more revenue.”