The government plans to roll out a Sh33 billion youth and women empowerment programmes in partnership with the World Bank known as the National Youth Opportunities Towards Advancement (NYOTA) and Kenya Jobs Economic Transformation project (KJET).

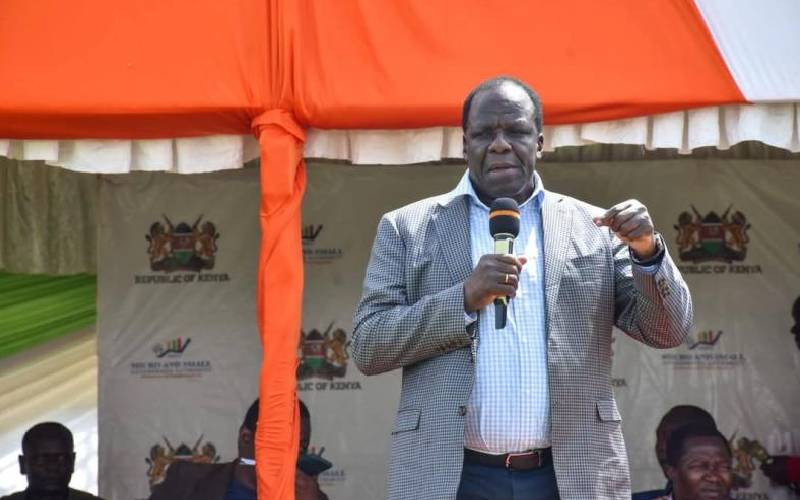

Cooperatives Cabinet Secretary Wycliffe Oparanya explained that Nyota seeks to empower youths with business training, mentorship and start-up grants of up to Sh50,000 while KJET seeks to integrate MSMEs into value chains with improved infrastructure and sector specific training, empowering youth and women enterprises.

“The two programmes which will cost Sh33 billion are a joint venture between the government of Kenya and the World Bank are aimed at empowering women and youth in the country and should be supported by all Kenyans of goodwill,” said Oparanya.

At the same time, the CS said that the government is developing a system to track Kenyans who have defaulted on the Hustler Fund.

Oparanya who appeared before the Senate plenary to answer questions on Wednesday, said they are also carrying out an impact assessment of the fund since its roll-out in 2022 to determine whether it has fully achieved its intention of empowering the Kenyan youths.

The CS told senators that the system aims to address the rising number of Hustler Fund defaulters, which has led to a significant portion of the fund being declared bad debt and called on Kenyans who have borrowed money to repay so that it can be beneficial to others.

He said noted that the Hustler Fund which was launched shortly after the 2022 elections, was misunderstood by some borrowers as a government handout programme that does not need to be returned which was not the case since it is a revolving fund.

“It is very unfortunate that when we have programmes like the Hustler Fund which are introduced after elections, many people believe they are being rewarded, which has contributed to the high number of defaulters, we are working on a system to recover the money,” said Oparanya.

The CS did not disclose the number of borrowers in default or the total amount of bad debt.

Data from the State Department for Micro, Small, and Medium Enterprises (MSMEs), released in September last year, revealed that the default rate had surpassed 50 per cent with the report showing that more than half borrowers had failed to repay loans totaling Sh11 billion.

Appearing before the National Assembly’s Special Funds Account Committee in October, Hustler Fund Acting CEO Elizabeth Nkuku said that despite several reminders, many early borrowers had defaulted.

“The Hustler Fund borrowers are mostly people who borrowed during the first and second months with default amount standing at about Sh7 billion, we are appealing to them to ensure they repay their loans so that others can benefit,” Nkuku told the committee at the time.

According to Oparanya, over 25 million Kenyans have benefited from the Hustler Fund since its inception, with over Sh70 billion disbursed so far. Of the total beneficiaries, about two million have moved to higher loan limits due to strong repayment records.

The CS said these borrowers have earned higher limit up to Sh150,000 with the fund working well and supporting many Kenyans, despite initial challenges.

Stay informed. Subscribe to our newsletter

“The Hustler Fund is a state-run digital lending platform intended to provide affordable credit and protect Kenyans from predatory online lenders which does not require collateral or a credit history for beneficiaries to get the loans,” said Oparanya.