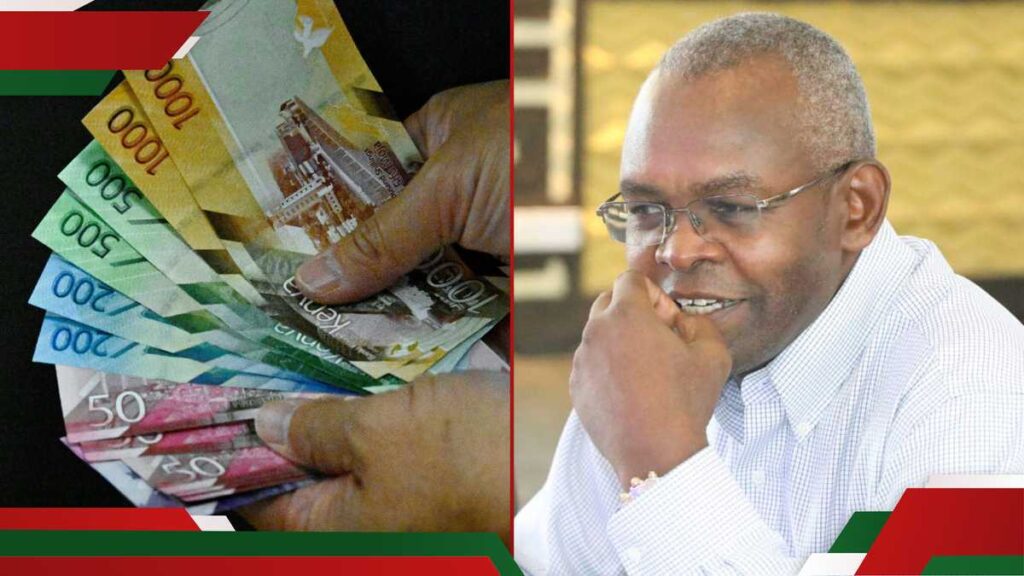

- People with disabilities in Kenya urged the Treasury and National Assembly to review existing tax exemption laws

- The current order allows individuals with disabilities to apply for income tax exemptions on earnings up to KSh 150,000 per month or KSh 1.8 million annually

- Disabled People Northern Kenya Chairman Hafid Maalim criticised the requirement to renew disability certificates every five years, stating it is unnecessary

- The group called on the Kenya Revenue Authority to ensure compliance with existing tax relief regulations, urging employers to provide the mandated monthly tax relief

Didacus Malowa, a journalist at TUKO.co.ke, brings over three years of experience covering politics and current affairs in Kenya.

Nairobi – People with Disability in Kenya are calling on the Treasury and the National Assembly to consider reviewing existing laws on tax exemptions.

Read also

KRA’s 3% tax on crypto transactions: Digital asset players engage taxman over new regulations

Source: UGC

They want further amendments to the Persons with Disability Act 2003 and The Persons with Disabilities (Income Tax Deductions and Exemptions) Order 2010, which forms the legal basis for granting of Income Tax Exemption for persons with disability.

The order provides that persons with disabilities who are in receipt of an income may apply to the Cabinet Secretary responsible for Finance for exemption from income tax and any other levies on such income.

This exemption applies on the first KSh 150, 000 per month or KSh 1.8m per annum.

Kenya disabled persons car import tax exemption requirements

To qualify for tax exemption under the cited provisions, the applicant must have a disability assessment report that details the nature of the disability from a government-gazetted hospital, be registered with the Council for Persons with Disabilities (NCPWDs) and be in possession of a disability membership card.

Read also

Govt advertises over 230 jobs for nurses in Qatar paying KSh 142k to KSh 172k

The persons must be in receipt of income that is subject of tax under the Income Tax Act.

The Disabled People Northern Kenya Chairman Hafid Maalim said what is needed is a review on the requirement to renew certificates every five years.

“This is unnecessary because in many cases,the disability doesn’t go away or change,” he said.

He has proposed that tax exs should be blanket to all taxes, including VAT, to avoid confusion.

“The exemption process should also be made easier as majority of these PWDs need accomodations,

He is also proposing that the VAT Special Table be abolished as it provides an avenue for corruption.

The group also wants KRA to ensure that employers give workers with disability Sh,36,700/ monthly tax reliefs as provided in law because some employers are not implementing it.

“As much as we want these tax reliefs to be reviewed upwards, we want the existing regulations to be complied with first,” he explained.

Source: TUKO.co.ke