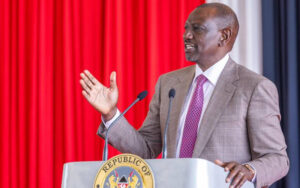

President William Ruto on Wednesday defended the Hustler Fund against mounting criticism, dismissing claims that the state-backed microloan program is failing.

Speaking during the Presidential Private Sector Roundtable at Ole Sereni Hotel in Nairobi, Ruto accused unnamed non-governmental organisations (NGOs) of deliberately misrepresenting the achievement of the scheme since it launched in late 2022.

On Monday this week, the Kenya Human Rights Commission (KHRC) called for the termination of the Fund, citing a reported 68 percent default rate and arguing the initiative is unsustainable.

“Our critics- the naysayers, the perpetual pessimists, the chorus that never sees anything working in Kenya- would have you believe that the Hustler Fund is a total failure,” said Ruto.

“Those same critics are spreading fear and despondency by falsely claiming that the fund has a 60 per cent default rate. That is a deliberate distortion of facts. The truth – backed by data – is that the Hustler Fund has a recovery rate of 83.3 per cent, nearly identical to that of the formal banking sector, whose repayment rate stands at 83.6 per cent,” he added.

President Ruto says that in just under three years, the Hustler Fund has disbursed over KSh 76 billion to 26 million Kenyans. However, he noted, some critics would have the public believe it is a failure. pic.twitter.com/dF9PHsxjTC

— The Standard Digital (@StandardKenya) August 6, 2025

KHRC questioned the impact of the program, noting that many loans are as low as Sh500 and unlikely to drive meaningful economic change. The commission also branded the fund a political tool of the Kenya Kwanza administration.

Ruto countered that view, saying the critics ignore the realities of those in the informal sector, whom the fund was designed to support.

“To them (the critics), a micro-loan of Sh1,000 seems too small to matter. But that is only because they have never walked in the shoes of those who were left at the margins of our society for far too long. They have never experienced the despair of being locked out of the financial system, of having no credit history, no collateral, and no chance,” remarked Ruto.

Despite KHRC’s concerns, Ruto said the Hustler Fund has disbursed Sh72 billion to date, compared to Sh5 billion in savings.

He added that 26 million Kenyans have used the platform, with 2 million borrowing daily.

“What exactly are they saying? That ordinary, hardworking Kenyans – the mama mboga, boda boda riders, Jua Kali artisans – are serial defaulters? Kenyans are better than that. Kenyans are honest. Kenyans are resilient. Given the right tools and a fair chance, Kenyans will always do their part,” he said.

The right’s body report, Failing the Hustlers, alleged a steady rise in loan default rates over the past three years.

Stay informed. Subscribe to our newsletter