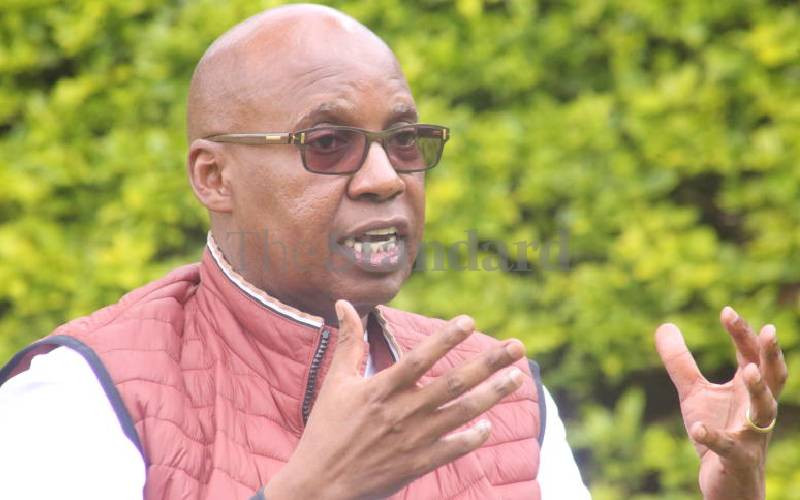

- Treasury CS John Mbadi noted that his ministry should balance tax administration to ensure a fair collection of revenues

- Mbadi said he wants to reduce the corporate income tax rate from 30% to 25% and Value Added Tax (VAT) from 16% to 14%

- The CS revealed that the government has been misusing the taxes collected from Kenyans and the process of a zero-based budget had started

TUKO.co.ke journalist Japhet Ruto has over eight years of experience in financial, business, and technology reporting and offers profound insights into Kenyan and global economic trends.

Treasury Cabinet Secretary (CS) John Mbadi has said the government may not introduce new tax laws in 2025.

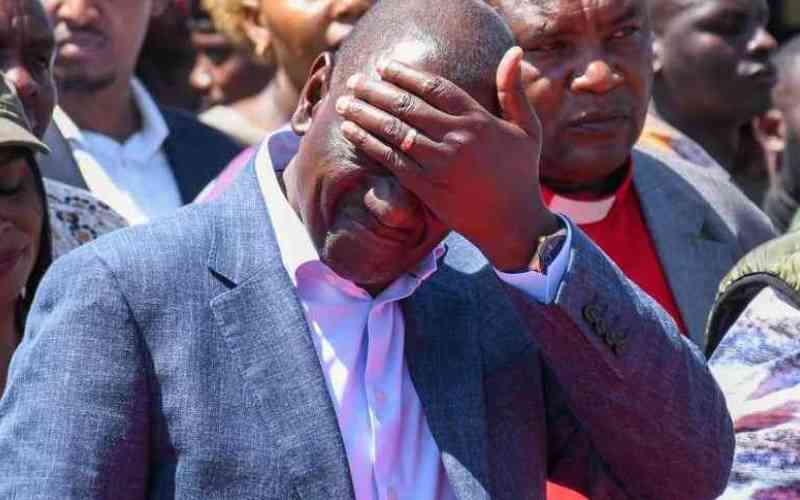

Source: Twitter

Why Treasury may not table Finance Bill 2025

Mbadi hinted the exchequer was contemplating avoiding the Finance Bill 2025 to avoid burdening taxpayers.

Read also

Govt seeks to raise KSh 170b by re-introducing sections of Finance Bill 2024

Speaking to Citizen TV on Wednesday, November 6, the CS noted that his ministry should balance tax administration to ensure a fair collection of revenues.

“It is in our tax policy to make sure that tax is predictable, and that is why we have said we will not be making many changes to our tax laws. As a matter of fact, we are even discussing at the Treasury whether next year we should just avoid bringing anything called the Finance Bill at all,” he explained.

Will Treasury reduce VAT and PAYE rates?

Mbadi said he wants to reduce the corporate income tax rate from 30% to 25% and Value Added Tax to 14% from 16%.

“We must be responsible so that we reduce taxation. We want to reduce corporate tax to at least 25%, VAT to 14% and also PAYE but we can only do that if every Kenyan who is supposed to pay tax pays.”

Read also

IMF advises William Ruto’s gov’t to introduce new taxes after approving KSh 78b loan

The CS revealed that the government has been misusing the taxes collected from Kenyans.

“We have started the process of a zero-based budget. We want to minimise human interaction with the procurement process,” he added.

Which bills will Treasury introduce?

However, National Treasury officials defended the government’s decision to re-introduce sections of the Finance Bill, 2024.

The exchequer noted that reintroducing rejected taxes would raise more revenues, enabling the country to cut borrowing.

The Treasury’s director general of budget, fiscal, and economic affairs, Albert Mwenda, said the government hopes to raise KSh 170 billion.

This is through the Tax Laws (Amendment) Bill, 2024, the Tax Procedures (Amendment) Bill, 2024, and the Public Finance Management (Amendment) Bill, 2024.

Source: TUKO.co.ke