By exploring the principles in Ecclesiastes 11:2, 4, and 6, we can see how African leaders and entrepreneurs are harnessing these values to build secure and prosperous lives.

Diversify your portfolio [Ecclesiastes 11:2]

Ecclesiastes 11:2 advises, “Invest in seven ventures, yes, in eight; you do not know what disaster may come upon the land.” This is a timeless call to diversify.

In Africa, where economies are highly sensitive to global fluctuations in commodities, diversification provides a buffer against unexpected downturns.

For example, Nigerian businessman Tony Elumelu has embraced diversification as a core strategy for his success. Elumelu, a prominent entrepreneur, has interests in banking, energy, real estate, and philanthropy.

Through his company, Heirs Holdings, Elumelu has invested in various industries, reducing his exposure to risk in any single sector. Elumelu’s philosophy embodies the principle of spreading investments across different ventures.

As he puts it, “We need to diversify our economies and build on our natural strengths.”

By diversifying, Elumelu has created a financial empire that is less vulnerable to single-sector economic shifts, demonstrating the resilience that comes with varied investments.

Don’t wait too long to act [Ecclesiastes 11:4]

Verse 4 of Ecclesiastes says, “Whoever watches the wind will not plant; whoever looks at the clouds will not reap.” This verse speaks to the danger of waiting too long to act, especially in uncertain conditions.

In Africa, where political and economic uncertainties are part of daily life, waiting for the perfect time often means missed opportunities.

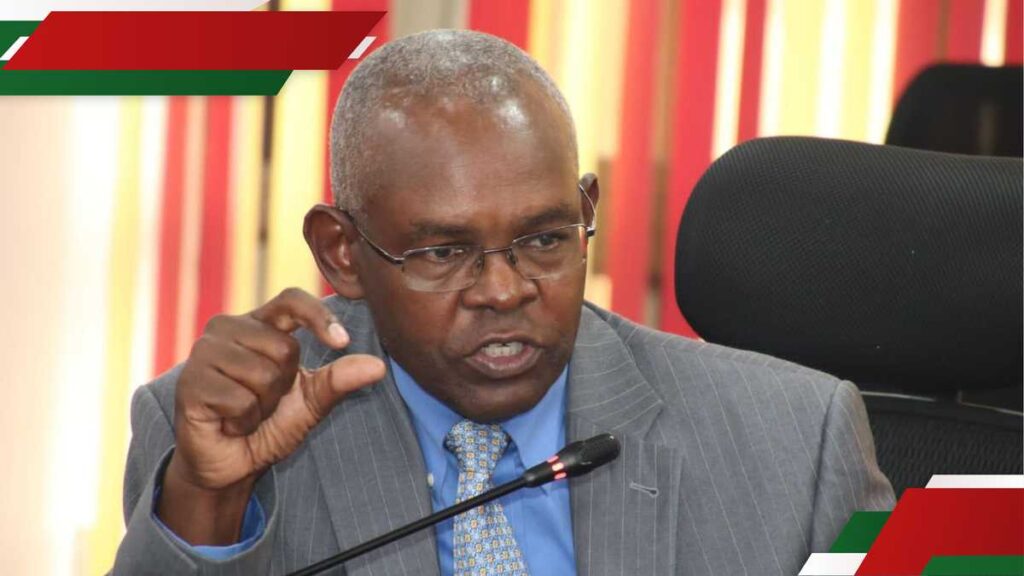

Known for his work as a venture capitalist and motivational speaker, Thembekwayo has spoken openly about the importance of not letting fear or economic conditions hold back one’s ambition.

He explains, “The opportunity will never feel perfect; you have to be courageous enough to take it.”

Despite South Africa’s economic instability, Thembekwayo has consistently taken bold steps, building multiple businesses in education, finance, and technology. His willingness to act, regardless of the clouds of uncertainty, has led to significant success and inspired many across Africa.

Consistent, ongoing effort [Ecclesiastes 11:6]

Verse 6 of Ecclesiastes states, “Sow your seed in the morning, and at evening let your hands not be idle, for you do not know which will succeed, whether this or that, or whether both will do equally well.”

This verse emphasises the importance of consistent, ongoing effort. Success rarely happens overnight; it requires daily dedication and perseverance.

A notable example is Kenyan entrepreneur Manu Chandaria. Chandaria, who heads Comcraft, an industrial conglomerate with interests across 40 countries, emphasises that his achievements stem from years of hard work and dedication.

Despite his success, Chandaria remains active in his work, often spending long hours building his business and supporting philanthropic initiatives.

He often says, “Success is built over time, with patience and persistence.” Chandaria’s journey underscores the power of consistent effort and illustrates the value of “sowing seeds” in various areas to reap a harvest over time.

Practical Steps for Financial Empowerment

- Start Small, But Start Now

You don’t need a large amount of capital to begin investing. Start with what you have, even if it’s a small savings account, and let that grow. Nigerian fintech entrepreneur Tayo Oviosu started small with Paga, which has now grown into one of the most widely used payment platforms in Africa. He says, “Just begin. Great things start small, and time will bring growth.”

Following the principle of “seven, yes, eight” can mean exploring different industries or income sources. Tony Elumelu’s success across banking, energy, and real estate shows the power of a balanced approach.

There may never be a “perfect time” to launch a business or make an investment. Embrace calculated risks, understanding that uncertainty is part of the journey. Vusi Thembekwayo’s story demonstrates that waiting too long can mean missed opportunities.

Financial growth is a long game. Keep working towards your goals, even if progress seems slow. Manu Chandaria’s daily efforts remind us that dedication is the bedrock of sustainable success.

In closing, Ecclesiastes 11 provides invaluable insights into building wealth and securing a future, especially for men in Africa’s complex economic landscape.

By taking inspiration from leaders like Tony Elumelu, Vusi Thembekwayo, and Manu Chandaria, we see how a mix of diversification, courage, and consistent effort can lead to financial empowerment.

With patience, perseverance, and a willingness to act despite uncertainty, African men can create resilient financial foundations that support their families and communities through prosperous and challenging times alike.

Recognising the societal pressures men face, Pulse Kenya has partnered with Money Clinic for the second edition of the Average Joes forum happening on November 23, 2024. The organisers are committed to creating a supportive, media-free environment where attendees can openly share and learn from one another.