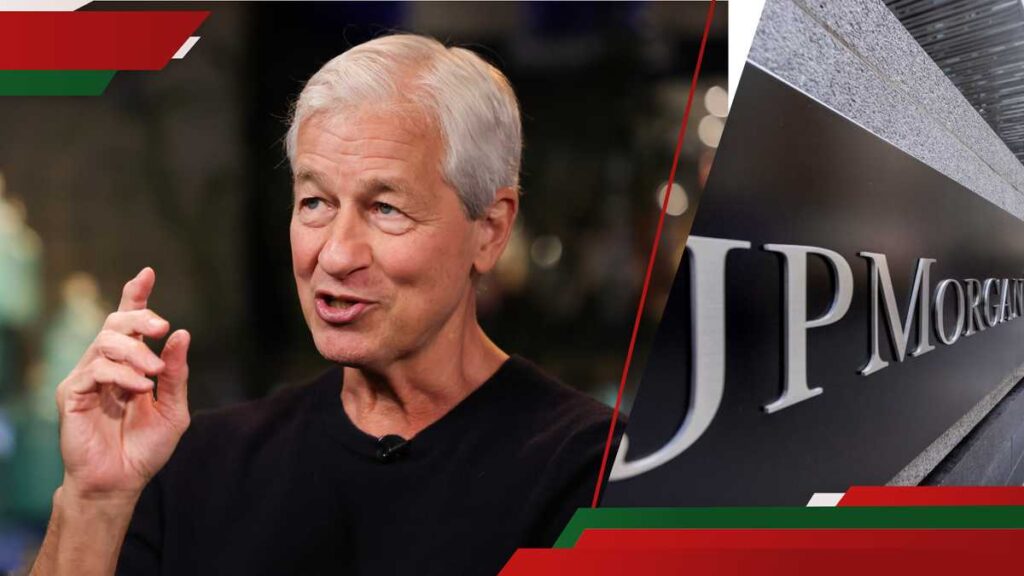

- JP Morgan Chase received approval from Kenya’s Central Bank to establish offices in the country, signaling a major development for Kenya’s financial sector

- Unlike traditional banking activities, JP Morgan will focus on exploring business and investment opportunities across Kenya and the East African region

- JP Morgan’s arrival is seen as a positive signal for foreign investors, potentially attracting more multinational corporations to Kenya and catalyzing economic growth across East Africa

Don’t miss out! Join Tuko.co.ke Sports News channel on WhatsApp now!

Elijah Ntongai, a journalist at TUKO.co.ke, has more than three years of financial, business, and technology research and reporting expertise, providing insights into Kenyan and global trends.

JP Morgan Chase, one of the world’s leading investment banks, recently received approval from the Central Bank of Kenya (CBK) to set up offices in the country.

Source: Getty Images

Following a meeting with JP Morgan CEO Jamie Dimon, President William Ruto said that JP Morgan will not engage in usual banking activities but will explore business and investment opportunities in Kenya and the entire East African region.

Read also

Asian shares rise as markets await tech results

This move is anticipated to have wide-ranging effects on Kenya’s banking sector and foreign investment across East Africa.

Do not miss an opportunity to join FREE webinar “AI in Action: Practical Skills for Creative Professionals.” Register here.

Positive impact on the banking sector

Industry experts believe the entry of such a global powerhouse could transform Kenya’s financial landscape, bringing competition, partnerships, and increased investor confidence to the market.

Reimond Molenje, Acting CEO of the Kenya Bankers Association (KBA), expressed optimism about JP Morgan’s arrival, highlighting the positive effects it could have on competition and innovation within the local banking sector, particularly in investment sectors.

“KBA believes in open entry and open exit of financial institutions to the market. This helps ensure that all client segments are served, as not all banks cater to every market segment. Competition is beneficial for fostering innovation and product development, while also supporting more competitive pricing for products and services,” Molenje told TUKO.co.ke.

Read also

AU-IBAR’s APMD platform seeks to revolutionise Africa’s livestock markets

JP Morgan’s global reputation and wide range of financial services, from corporate governance to treasury and asset management, could make it an attractive option for large corporations and investors seeking comprehensive banking solutions.

However, Molenje remains confident that the competition will drive growth rather than disrupt the market.

Molenje further pointed out that Kenyan banks are already linked to other global banks for correspondent banking practices, which support transaction clearing in resident jurisdictions.

He expressed optimism that JP Morgan will continue to partner with local banks for various services moving forward which could not only strengthen Kenya’s banking sector but also help local banks access new markets and products through JP Morgan’s extensive international network.

Positive signal for foreign investors

Alvin Khama, a Senior Investment Analyst at Orient Assent Managers, sees JP Morgan’s presence as a positive signal to global investors.

“Once JP Morgan establishes itself in Kenya, it will signal the diversity and maturity of Kenya’s financial sector, catalysing trade and investment in the country and across the East African region,” Khama said in an exclusive interview with TUKO.co.ke.

Read also

Kenya’s livestock economy eyes new markets with APMD launch

“The presence of a renowned institution like JP Morgan not only reaffirms Kenya’s standing as a premier financial services hub but also has the potential to attract other multinational corporations and financial institutions,” Khama added.

Khama’s views were buttressed by Molenje who noted that the bank’s move will encourage more foreign investors to explore opportunities in Kenya, viewing JP Morgan’s decision as a stamp of confidence in the country’s economic potential.

Impact on East Africa

JP Morgan’s entry into Kenya may also significantly affect the broader East African region. Kenya is a financial gateway to East Africa, with more than eight Kenyan banks already operating in neighbouring countries within the East African Community (EAC).

According to Molenje, the growth of Kenya’s banking sector in terms of service diversity and competition could spark financial development across the region.

“Kenya’s banking system acts as a regional financial hub serving the EAC and beyond. The growth here triggers a ripple effect, promoting financial sector development in the neighboring economies,” he noted.

Read also

IMF chief seeks more details on BRICS payments system plans

While JP Morgan’s expansion will likely boost Kenya’s economic standing, Khama cautioned that the full impact would become clear over time as the bank gradually scales up its operations.

“It’s still early in the process, so we’re taking a ‘wait and see’ approach. However, the bank’s long-term strategic presence will likely align with Kenya’s economic growth plans, especially in sectors like trade, agriculture, and services,” Khama remarked.

Notably, industry experts believe that JP Morgan Chase’s entry into Kenya is more than just an expansion of its global footprint; it will serve as a signal to the world that Kenya is ripe for business and investment.

The move offers both opportunities and challenges for businesses and investors but the whole picture will be evident with time.

Source: TUKO.co.ke