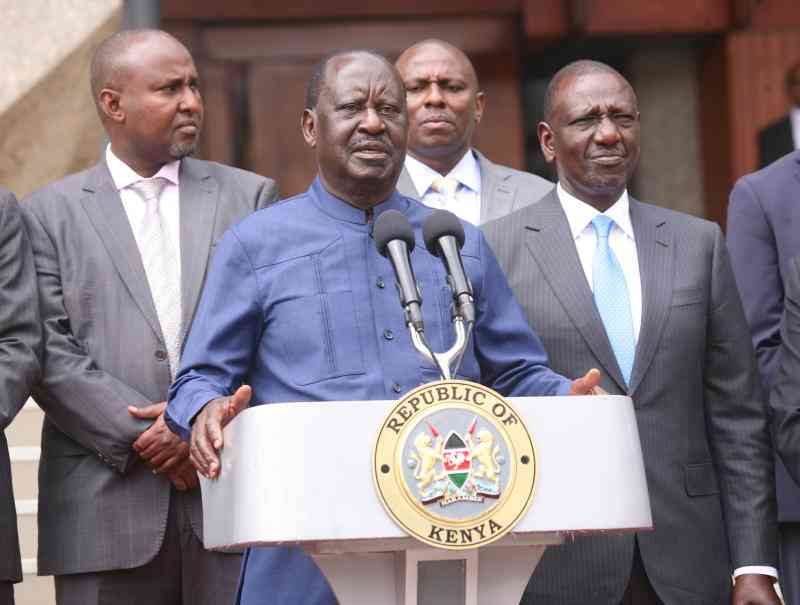

Barely two years into President William Ruto’s tenure, Kenya Kwanza’s much-hyped bottom-up economic model is not working, according to a report from the Parliamentary Budget Office (PBO).

Expected to empower Kenyans in the lower income brackets, the plan’s ambitious promises on job creation, business growth and more accessible government services have come under scrutiny against prevailing economic hardships.

The report, which evaluates the economic policy for the 2024/2025 financial year, points to multiple obstacles that have impeded the bottom-up model’s effectiveness.

Among these are rising taxes, increased levies and inefficient resource allocation. Of particular note is the growing tax burden that many Kenyans are shouldering, which stands in stark contrast to campaign promises to reduce taxes and make life more affordable for the average citizen.

Tax policies have undergone frequent changes, with new levies introduced to boost revenue. However, PBO analysts argue that these changes haven’t always translated to higher revenue collection and instead may have stifled economic activity.

“Future tax policies must consider ripple effects to avoid undermining revenue collection,” the report advises, suggesting that an alternative approach to revenue generation may be needed to avoid further straining taxpayers.

One of the most significant concerns raised is the stagnation of several government projects despite the availability of funding. The report highlights that substantial financial resources, often accessed through loans, remain underutilised, with many planned initiatives yet to commence. This has prompted questions about accountability, governance and the government’s ability to meet contractual deadlines.

In the 2022/2023 audit, the Auditor General flagged approximately Sh133.4 million in ineligible expenditures across several projects. The PBO also raised concerns about double allocations for projects and systemic non-compliance with procurement laws.

The report notes that the delay in implementing the Finance Bill, 2024, has forced a drastic cut in development allocations from Sh746.33 billion to Sh641.16 billion. This has led to a reduction in the government’s share of the Exchequer from 44 per cent to 34 per cent, which affects the capacity to finance domestic projects independently.

Simultaneously, the reliance on development partners has grown from 37 per cent to 43 per cent. Donor contribution is expected to reach Sh200 billion this financial year.

According to the report, over 200 development projects are affected.

In the health sector, the implementation of the Primary Health Care Act, 2023, has been hampered by funding shortfalls. The national government was supposed to provide Sh3.23 billion to counties to support health initiatives, including community health programmes. However, only Sh2.58 billion was allocated.

Stay informed. Subscribe to our newsletter

The report also brings to light inefficiencies in the handling of loans, highlighting the Sh1.4 billion paid in commitment fees for undrawn loans in 2022/2023. These fees are incurred when the government commits to loans that are later not accessed in full.

Revenue tied up in unresolved disputes also hampers the economic transformation agenda. As of the latest report, about Sh313.4 billion remains locked in pending disputes across 1,288 cases. The report suggests that the Kenya Revenue Authority (KRA) and taxpayers resolve these disputes through an Alternative Dispute Resolution framework.

Projects in the agricultural sector, crucial for the rural economy, also face difficulties. Programmes like the National Agricultural Rural and Inclusive Growth Project and the Agricultural Sector Development Support Programme have experienced low fund absorption.

The delay in approving the County Government Additional Allocation of Revenue Bill has further complicated county-level project funding. This has affected everything from infrastructure development to health and education services.

The informal sector, which accounts for 83.4 per cent of employment in Kenya, presents challenges for tax compliance and revenue collection.

While digital tax systems like eTIMS offer a way to simplify tax processes, many small businesses lack proper financial records. Collaboration between national and county governments to improve business registration and record-keeping could help, though concerns about data privacy and cybersecurity remain key issues to address.

Simplifying tax procedures for small- and medium-sized businesses could enhance compliance and boost revenue, aligning with the Kenya Kwanza administration’s objectives, according to the report.

However, without significant support for these businesses, the bottom-up model may fall short of reaching the very people it aims to uplift.

The government’s reliance on foreign borrowing raises concerns about debt sustainability.

Cuts in development expenditure are increasingly favouring foreign loans, leading to higher debt servicing costs and foreign exchange risks. While external funding is essential, the growing debt burden could create significant challenges for fiscal stability.

The PBO report recommends the need to balance tax policies with economic activity to avoid overburdening Kenyans.

For the revenue target of Sh3.1 trillion for this financial year, the government should focus on strengthening tax enforcement and improving data analysis for more effective tax collection.

The report also stresses that, to achieve fiscal consolidation and reduce the debt-to-GDP ratio to the target 55 per cent by 2029, Kenya should expedite the completion of donor-funded projects and foster a conducive environment for the private sector. Implementing these measures could lead to improved compliance and better revenue collection, essential for long-term fiscal sustainability.

Furthermore, the government needs to adopt a more strategic approach to project management, ensuring that resources are allocated efficiently and that projects commence promptly to avoid incurring unnecessary costs.

Enhanced monitoring of public funds and a more stringent approach to fiduciary responsibilities are also vital in restoring public trust and achieving Kenya’s development goals.