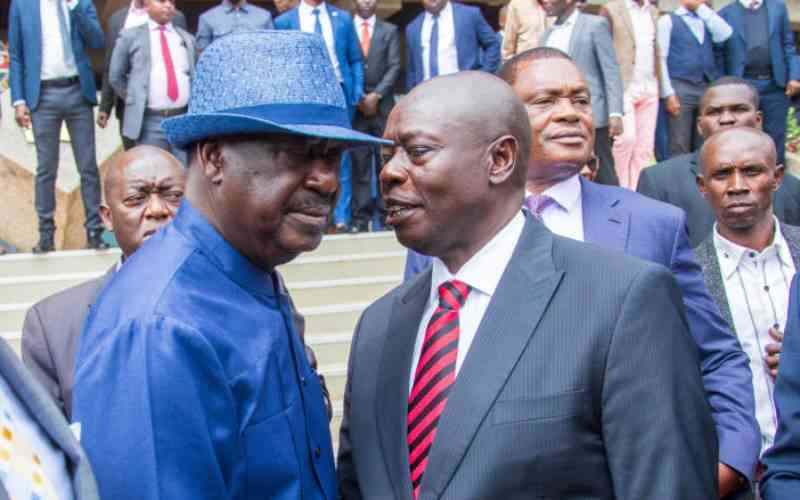

Additional taxes are now imminent in the coming financial year following an announcement by National Treasury Cabinet Secretary John Mbadi, who said that new revenue-raising measures will be unveiled on 12 June.

Mbadi, speaking during an interview on Friday, revealed that the date had been agreed upon after consultations with his counterparts from the East African region, held in Uganda.

“I suggested to my colleagues that we read our budgets on the 12th of June, and they seemed to have agreed. Actually, it was initially proposed by the Tanzanian minister,” Mbadi stated.

He went on to clarify that the date will be focused on outlining the budget policy highlights and revenue-raising measures.

“But remember, even before I carry that briefcase to Parliament, any revenue-raising measures will already have been shared with the public in the form of the Finance Bill,” he added, expressing confidence that the government is keen to avoid the uproar that followed the announcement of the Finance Bill 2024.

It is worth noting that the Kenya Kwanza administration was last year forced to scrap tax increases amounting to Sh346 billion, which had been proposed in the 2024 Finance Bill, following widespread youth-led protests.

Mbadi’s remarks, however, came shortly after Molo MP and National Assembly Finance Committee Chairperson Kimani Kuria revealed that the government might introduce additional tax measures in the 2025 Finance Bill, should there be funding shortfalls in the 2025/26 financial year budget.

This comes in light of the fact that the National Assembly, in March, adopted the Sh4.3 trillion 2025/26 Budget Policy Statement, an increase from the Sh3.95 trillion allocated for the 2024/25 financial year.

Kuria noted that between now and June, the Finance Committee will assess whether revenue collection, appropriations, and aid will be sufficient to meet the higher budgetary ceiling. Should a gap be identified, additional taxation may be introduced.

“If that will not be sufficient to fund the budget, that is when there will be additional tax measures to raise more revenue. If there is empirical evidence to show that the already existing tax measures, appropriations, and donor commitments are enough to finance these ceilings, then there will be no need,” he stated.

Despite Mbadi’s projection of a 5.3 per cent economic growth in 2025—up from 4.6 per cent in 2024—mainly driven by the agriculture, ICT, tourism, and industry sectors, concerns remain over potential cuts in funding from Kenya’s donor partners, such as the European Union, following the suspension of foreign assistance due to new policies introduced by former U.S. President Donald Trump.

Government Spokesperson Isaac Mwaura, however, last week dismissed claims that the government intends to “punish” Kenyans with more taxes. On Monday, Mwaura clarified that the Finance Bill 2025 has not yet been proposed, drafted, or tabled in Parliament.

The Spokesperson urged Kenyans to disregard online claims regarding the 2025/26 budget process, stating that, according to established timelines, revenue-raising measures such as the Finance Bill only follow the release of the Draft Budget, which comes after 30 April.

“The 2025/26 budget process is still underway. Kenyans will be fully engaged through public participation once the Finance Bill is officially submitted to Parliament,” Mwaura said.

Stay informed. Subscribe to our newsletter

He reiterated that Kenyans will have the opportunity to scrutinise any proposed revenue-raising measures through a robust public participation process, and only after the Draft Budget and Finance Bill have been released by the National Treasury and submitted to Parliament.

Mwaura also emphasised that the key intervention at this stage is the Budget Policy Statement, which outlines the government’s strategic and policy goals to guide the national government, county governments, and independent constitutional institutions in preparing their respective budgets.