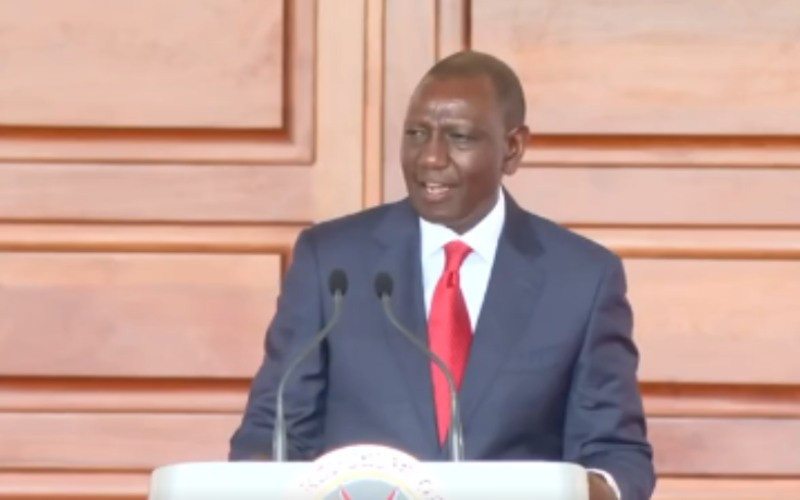

President William Ruto has called on the Kenyan banking industry to reduce interest rates on loans to spur the growth of Micro, Small, and Medium Enterprises (MSMEs).

Source: Twitter

Speaking during the Inua Biashara MSME Exhibition held at the KICC Ruto said that according to the Central Bank, Kenyan banks gave KSh 783 billion in loans to MSMEs in 2023.

“Our banks provided KSh 783 billion in loans to MSMEs in 2023, representing an increase of about KSh 75 billion. As we launch the MSME Accelerated Programme today, let us reflect and collaborate in advancing its stated aim of boosting small business capabilities through comprehensive assessments, advanced training, and tailored support from public and private sector partners, as well as development finance institutions,” Ruto said.

President Ruto commended the banking industry’s pledge to double lending to MSMEs by providing KSh 150 billion in new loans annually, beginning next year and pledged that the government will support this bold and innovative move through policy and institutional banking.

Read also

Wycliffe Oparanya urges dairy farmers to apply govt affordable credits through co-operatives

Collaboration between banks and Hustler Fund

Ruto also noted that John, the Chair of the Kenya Bankers Association, mentioned that 2 million people from the Hustler Fund into the MSME sector, with the announcement expected next month.

PAY ATTENTION: TUKO Needs Your Help! Take our Survey Now and See Improvements at TUKO.co.ke Tomorrow

Ruto said that this demonstrates the possibilities that exist in the financial sector considering the Hustler Fund is offering 8% interest rates while many banks are at 17%, 18%, or even above 20%.

“I want to highlight that the experience we’ve seen with the Hustler Fund, along with KCB and Family Bank, proves it is possible to do business with single-digit interest rates. We need to work together, leverage technology, and use KYCs (Know Your Customers) more effectively.

Sharing of information

The president said that the government, through the Hustler Fund, has collected a lot of information on borrowers, which can be shared with the banking sector to enhance lending to MSMEs.

Read also

AgriTech players project investment growth to KSh 387b targeting women entrepreneurs

“This information will include banking records and borrowing history, allowing banks to make more informed decisions on how much and when to lend to these borrowers. We are prepared to share this information so that we can develop more products to support our MSME ecosystem.

I am confident that the banking sector’s dedicated support program will enable MSMEs to develop scalable business models, strengthen financial management skills, and gain access to investors, markets, and formal credit,” Ruto said.

Source: TUKO.co.ke