Motorists who use their vehicles to smuggle goods into the country without paying taxes face a fresh legal setback after the High Court ruled that such vehicles are liable to forfeiture.

High Court Judge Diana Kavedza ruled that once a person is convicted of bringing goods into the country without paying taxes to the Kenya Revenue Authority (KRA), the vehicle used in the offence ceases to be private property and becomes a State asset.

She overturned a magistrate’s court order that had freed a vehicle to its owner following the conclusion of a trial.

“The conviction alone, in accordance with section 215, rendered the vehicle liable to forfeiture. The vehicle, therefore, ceased to be subject to private claim and became condemned in law upon his conviction. The trial court’s failure to consider this statutory consequence was a material misdirection,” ruled Justice Kavedza.

Possession of uncustomed goods or excisable goods affixed with counterfeit excise stamps constitutes an offence.

This means that vessels, aeroplanes and motor vehicles used to convey or transport such goods are not only crucial evidence in tax crime cases but are also liable to forfeiture under Section 211 of the East African Community Customs Management Act, 2004.

The case in question involved a Toyota Mark II that was to be released to Moses Wanjau Gichuki, who had been charged with three offences and convicted of possession of uncustomed goods. The vehicle itself also lacked importation and registration documents.

“The motor vehicle, being condemned property under the East African Community Customs Management Act, 2004 upon conviction, shall remain in lawful custody pending forfeiture proceedings,” she directed.

Last year, the High Court in Kakamega reversed an order for the release of a truck intercepted while it was in the process of ‘dumping’ 350 cartons containing 5,000 sticks of export Supermatch cigarettes worth Sh26 million at a residential house in Shuvumbe area, Kakamega County on October 15, 2023.

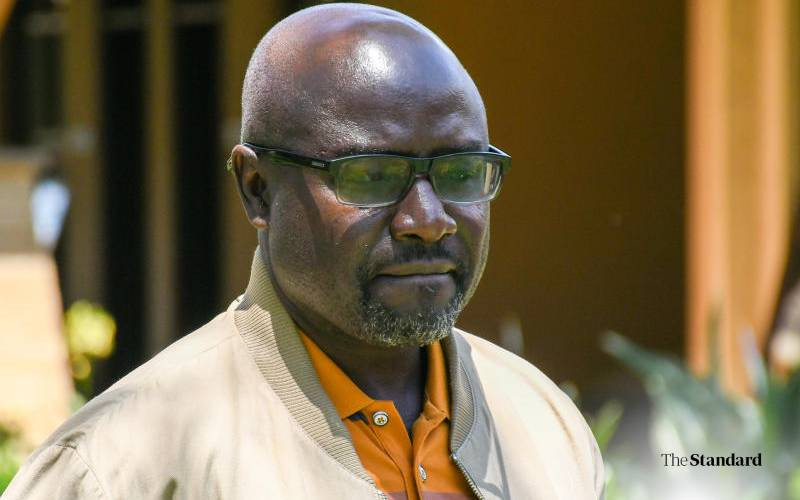

The court heard that the truck driver, Shadrack Kogo, failed to provide documents evidencing the origin of the consignment or payment of duties, leading to the seizure of both the truck and the cigarettes by KRA.

Kogo was charged in March 2024 with conveying uncustomed goods contrary to Section 199(b) of the East African Community Customs Management Act. He denied the charges and was released on a bond of Sh500,000. Trial court, however, directed the release of the truck to its owner Geoffrey Cheruiyot Bor pending determination of the case. KRA and the Office of the Director of Prosecution (ODPP) challenged the decision at the high court, arguing that the truck had been used to facilitate the offence and was, therefore liable to forfeiture.

Justice Alice Chepngetich Bett ruled that the trial court had erred in releasing the truck, which was an exhibit and could only be released upon production in court.

“By ordering the release of the truck without seeking to hear the party that issued the seizure notice, the trial court — which had notice that the seizure was executed by the Interested Party (KRA) — acted contrary to the law,” Bett held.

Stay informed. Subscribe to our newsletter

Similarly, in May this year, Nyeri High Court Judge Magare Kizito suspended a magistrate’s court order releasing a Toyota Voxy to its registered owner, Kevin Odhiambo, who is facing trial for possession and conveyance of uncustomed goods valued at Sh7 million.

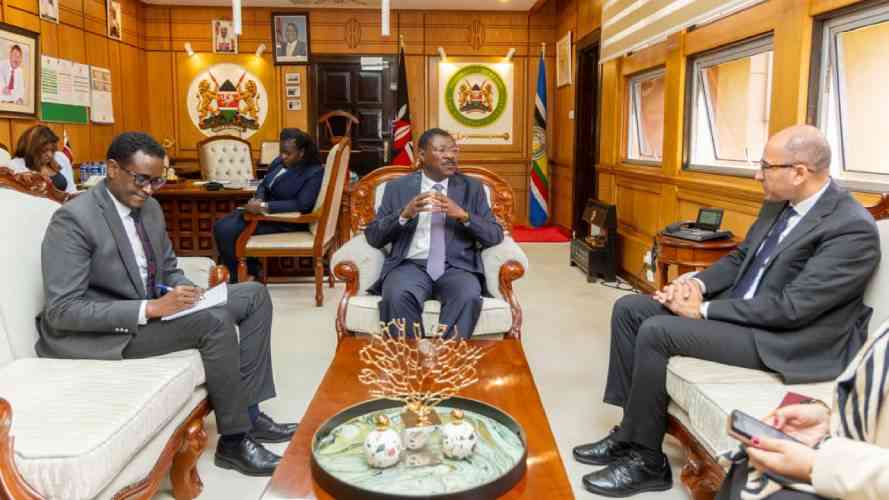

Acting Commissioner for Investigations and Enforcement, Levi Mukhweso, has since urged transporters, drivers and turn boys to ensure they have all requisite documentation while conveying goods both within and outside the region.

“Traders should purchase excisable products from licensed manufacturers and their approved distributors, while dealers must keep proper records, including but not limited to Electronic Tax Register (ETR) receipts, delivery notes, invoices and supplier contacts,” he said.