The government is set to miss out on billions in tax revenues from the alcoholic beverage sector, driven by lower sales, if a proposed policy on alcohol consumption becomes law.

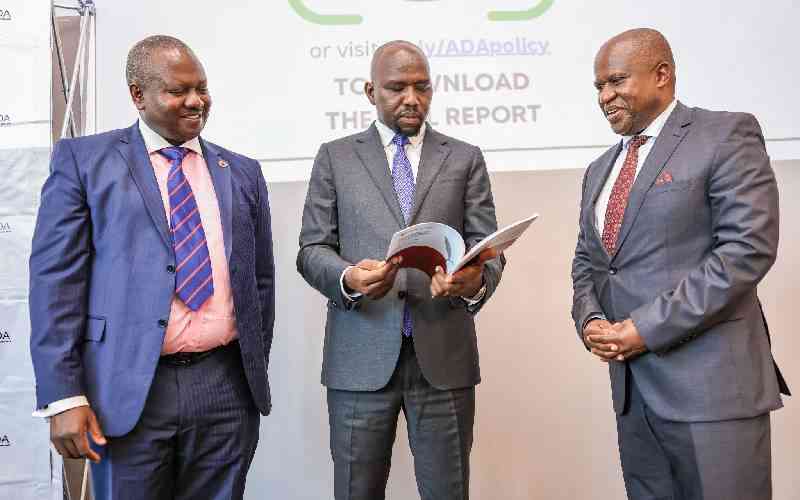

Manufacturers argue that the policy by the National Authority for the Campaign against Alcohol and Drug Abuse (Nacada) will shrink alcohol sales in formal outlets, thereby reducing tax revenue.

“There is no way to collect tax from illicit traders. This policy will drive more people towards illicit alcohol,” said Eric Kiniti, Corporate Relations Director at East African Breweries Ltd (EABL) and Secretary of the Alcoholic Beverages Association of Kenya (Abak).

Thousands of Kenyans working across the alcohol value chain could also be rendered jobless in the near future if Nacada’s recommendations are adopted.

Among those set to be affected are boda boda riders who rely on alcohol deliveries, as Nacada proposes to ban the practice.

Job cuts may also be imminent for cashiers, wines and spirits vendors, supermarket liquor store staff, and employees of large corporations and manufacturers of alcoholic beverages.

“This policy recommendation is going to have a huge impact across the entire value chain, including farmers, retailers, distributors, and suppliers,” Kiniti said on the sidelines of EABL announcing its 2025 full-year financial results yesterday. “If sales are impacted, this will have a significant effect on government revenue as well. Alcohol is a major contributor to the exchequer,” Kiniti added.

Nacada’s new policy attempts to reorganise the alcohol industry through a raft of proposals, including restrictions on sales in specific locations such as supermarkets, bans on content creation involving alcoholic brands, and raising the legal drinking age from 18 to 21 years.

In 2023, excise tax revenues from alcoholic beverages amounted to Sh51.01 billion, underscoring the sector’s significant fiscal contribution.

While the policy’s intention is to curb alcohol abuse—now rampant across the country—experts argue that the proposals fail to address the root causes: high youth unemployment and a struggling economy.

“Without tackling these issues, all other measures are likely to backfire. In fact, they could create opportunities for rent-seeking, fostering an environment ripe for extortion,” said Ken Gichinga, Chief Economist at Mentoria Economics, likening the alcohol policy to the failed attempt to restrict shisha sales.

“What will happen is that establishments currently operating in the formal sector and paying legitimate taxes—such as Pay As You Earn—will migrate to the informal sector, evading taxes and depriving the government of much-needed revenue.”

Gichinga warned this could trigger a vicious cycle, where the government attempts to recover lost revenue by increasing taxes in other areas such as fuel, further slowing the economy and diminishing overall collections.

Economist Patrick Muinde noted that one ripple effect could be a surge in the consumption of toxic brews.

Stay informed. Subscribe to our newsletter

“From a behavioural economics perspective, controls perceived as punitive by consumers often lead to the growth of black markets — illicit trade in this case — posing high risks of poisoning,” he said.

He added that there is no immediate fiscal solution to offset these losses, with the government facing potential billions in lost ‘sin tax’ revenue.

“We could learn from the taxes imposed on cheap but safe millet-based brews during the Kibaki era, which were heavily taxed in the 2015–16 fiscal year under Uhuru.

The sub-sector collapsed, taking down consumers, anticipated tax revenues, and contracted farmers with it,” Muinde added.

Abak also warned that e-commerce may suffer, impacting the youth and entrepreneurs who depend on it for income generation.

“It is going to impact e-commerce, which is a critical channel for us now. This will have a major impact on jobs within that sector,” Kiniti said.

With a growing number of statutory tax deductions from Kenyan incomes — including contributions to the Social Health Authority, the affordable housing levy, and higher income tax rates — disposable income for alcohol consumption is projected to shrink even further.

A report by Euromonitor International, published in May 2025, showed that despite associated risks such as poor health and death, many Kenyans knowingly consume illicit alcohol.

During the study period (2022 to 2024), 60 per cent of alcohol sold in the country was illicit, with sales estimated at Sh204 billion — costing the exchequer Sh120 billion in lost revenue.

It is also projected that retail prices for alcohol may rise significantly, making it unaffordable for many, as the number of formal outlets declines.

“Beyond pushing more people toward illicit alcohol, it will fuel organised crime, as people find new ways to sell alcohol without paying taxes or complying with regulations, turning it into a public health crisis,” Kiniti warned.

Nacada has proposed increasing the drinking age from 18 to 21 years.

Experts note that many within this age group already cannot afford formal alcohol, and are more likely to turn to illicit options.

“This is not a well-thought-out policy directive. I believe there will be serious unintended consequences. The social and health costs could be enormous

“We could have provided valuable input on what is practical and likely to work. As an industry, we were not consulted,” said Kiniti.