The National Treasury says it has started paying local firms’ pending bills, in what it expects will increase liquidity for many cash-strapped small businesses.

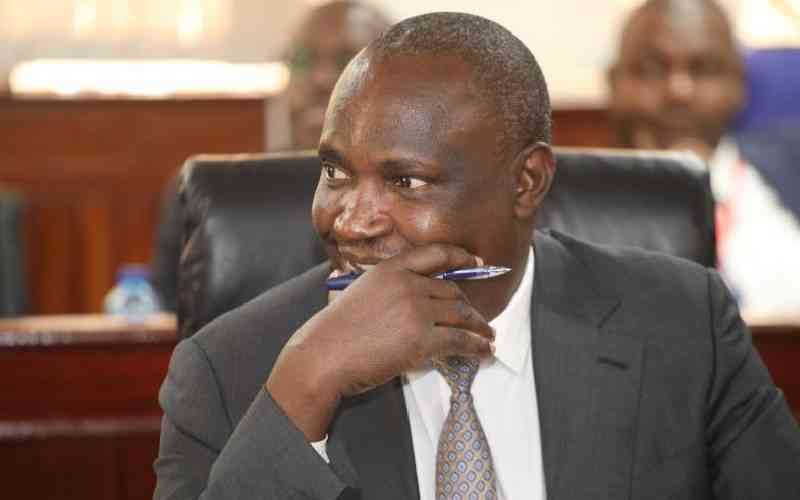

Cabinet Secretary John Mbadi said the government has prioritised the road sector as it looks to restart stalled road projects while injecting money into the economy.

He, however, said companies in other sectors would have to wait a little longer as Treasury awaits the conclusion of the review of pending bills by the verification committee.

“We have started the process of setting pending bills that have been validated, particularly those related to road construction, which has resulted in the resumption of road construction projects across the country, which have stalled completely for about two years. The pending bills are currently being verified,” said Mbadi. He spoke in Nairobi on Wednesday during the state of the oil and gas industry briefing for quarter one of 2025 by the Petroleum Institute of East Africa(PIEA).

Mbadi said the government has so far settled pending bills amounting to about Sh60 billion owed to road contractors.

He said the interim report by the pending bills verification committee, chaired by former Auditor General Edward Ouko, showed that it had been presented with bills worth Sh663 billion. In the report, the committee had recommended the settlement of Sh229 billion. The Ouko committee has, since September 2023, been looking into pending bills dating back to 2005.

According to the Controller of Budget, the national and county governments owe different businesses a combined Sh684.26 billion as of March this year.

The bulk of this is owed by the national government at Sh511.75 billion, while counties’ pending bills stood at Sh172.51 billion, with Nairobi County accounting for the largest share of Sh115.69 billion or 67 per cent of the counties’ pending bills.

CS Mbadi has in the past stated that more than 95 percent of the pending bills reviewed by the committee are claims for amounts below Sh10 million, which are mostly owed to small and medium-sized enterprises.

He decried the high debt service cost, citing it as among the risks that are likely to threaten the country’s economic stability.

“Interest cost is now the single largest expenditure item on the recurrent budget, exceeding the National Government wage bill and dwarfing the county governments’ equitable revenue share,” said the CS.

“Whereas we intend to transfer Sh415 billion to counties, whereas we spend not more than Sh960 billion on the wage bill, which is very high, we spend about Sh1.1 trillion on interest rates. This underlines the importance of restoring the country’s external creditworthiness,” he added.

On thinning fiscal space, he said Kenya’s public debt as a percentage of GDP has risen to 69.7 per cent from 46 per cent in 2010.

Kenya’s debt stood at Sh11.36 trillion as of March this year, or about 67 per cent of GDP, against a target of 55 per cent by 2028.

Stay informed. Subscribe to our newsletter

“The current present value of public debt to GDP is 67.2 per cent. You are aware that we are supposed to move it to 55 per cent by 2028. Our debt service payment is equivalent to about 63 per cent of ordinary revenue,” said Mbadi.

He said, despite this, the country has not failed on its debt obligations, and it was the only African country among the six that did not fail, as it had been predicted by the International Monetary Fund(IMF) by 2021.

At the petroleum industry meeting, oil industry players called for a predictable business environment, saying the fiscal and monetary policy should be such that businesses are able to plan going forward.

IPEA Chairman Peter Murungi said that through the government’s support, the lobby has managed to overcome industry shocks since 2020.

These include the government’s release of funds owed to the sector, which started accruing after the State started subsidising petroleum products at the pump, which saw marketers forego their margins and claim them later from Treasury.

Initially, this was marked by major delays that saw oil firms suffer cash flow challenges.

“Specifically, your ministry has been able to timely release stabilisation funds and we have come from the highest of Sh60 billion,” he said.