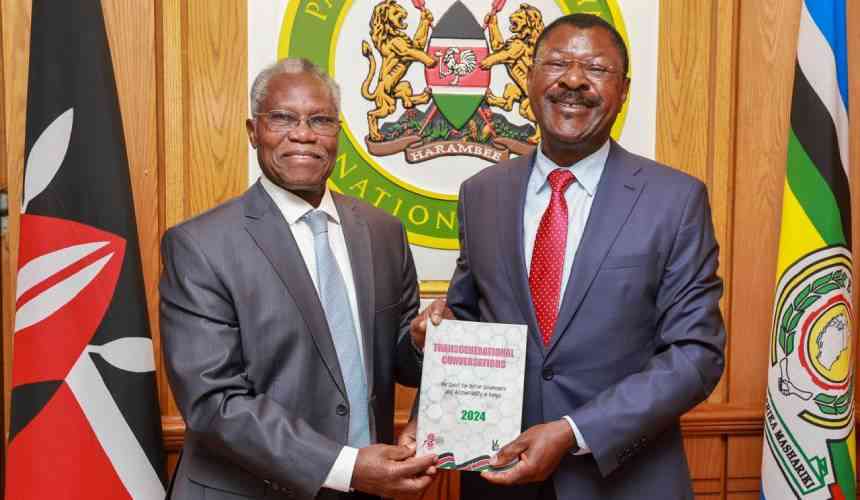

In fulfillment of her mandate under Article 229(6) of the Constitution, the Auditor General (AG) has published the Audited Financial Reports for the National and County Governments. The consolidated audit report for each level of government is technically referred to as the Green Book.

In theory, the AG works for and reports directly to the people of Kenya through their elected representatives. Technically, this means that her reports are meant for use by the citizens to understand how those they elected into the Executive applied their taxes.

In a democracy like ours, citizens delegate this oversight responsibility to the men and women that they elect into the legislature each five years. That is why one of the principal responsibilities of the Members of Parliament and County Assemblies is oversight. That notwithstanding, the citizen still retains the right to exercise their oversight roles directly. It is on this right that in today’s article we turn our focus on key highlights from the Auditor reports.

Notably, there are gallant citizens both in mainstream and social media who have taken it upon themselves to highlight key issues emanating from the reports for individual public entities. Here, I shall limit myself to issues emerging from the summary reports.

Under the Constitution and the Public Audit Act of 2015, the Auditor General is obligated to complete audit of all government entities within six months after the end of the fiscal year. That places the cut-off date to December 31 each calendar year. This is because the fiscal year of the government ends on June 30. As the AG indicates in the forward of her reports, this is an enormous burden placed on her shoulders given the number of public entities that she must audit.

For instance, recent entities that have been brought into the ambit of her work are public secondary schools, and all health facilities from Level 4 category and above. In her 2023/24 report, the AG indicates that she was able to sample 486 secondary schools of the total over 9,000 public schools, 224 Level 4 health facilities from a total of 376, and all Level 5 and Level 6 hospitals.

The Public Finance Management Act of 2012, grants public entities 90 days to prepare and submit their accounts for audit. Effectively, this takes away 90 precious days from the AG’s Constitutional limit of six months. However, in consideration of the strict timelines fixed by the Constitution, the National Treasury has since issued a circular to reduce the timelines for preparing financial reports to 60 days. Thus, effective from 2024/25 fiscal year, all public entities are obligated to submit their reports for audit by August 31.

Audit opinions

As per this Constitutional obligation, the AG has done a commendable job to complete and publish the reports in January 2025. Another notable improvement is on the type of audit opinions issued for various entities. Within the practice of audit, external auditors’ issue one of four possible opinions for each audit they undertake. These are Unqualified/unmodified, Qualified/modified, Adverse or Disclaimer opinion.

In street language, an Unqualified audit opinion is the clean opinion. This means that based on the evidence presented before the auditor, the financial statements prepared by management are true and correct. Qualified opinion means that the reports are true and correct, except for an important fact that the auditor could not verify or confirm based on the evidence presented to him/her.

Adverse opinion means the auditor found sufficient evidence that the statements presented before him/her are not true and correct. Disclaimer opinion means that the auditor cannot tell whether the reports are true or correct. Thus, the auditor lacks sufficient evidence on the financial reports or they are so disorganized that they cannot make any opinion over them.

These audit opinions are presented as independent and objectively determined based on facts and reliable evidence only. That is why the AG is a Constitutional Independent Office with a guaranteed tenure. However, for our context, the audit reports are not complete until relevant parliamentary committees of the National Assembly have considered and approved them.

In county governments, the Supreme Court recently confirmed that the County Assemblies have the primary right to oversight County Executives with the Senate Public Accounts and Investments committee as another layer of oversight for devolved funds.

Given these types of reports, there are notable improvements for majority of public entities from the opinions of the AG. Several national government entities received the Unqualified opinion and many others got the qualified opinion. This means that majority of national government entities have utilized public resources within the law and in compliance with their budgets.

Stay informed. Subscribe to our newsletter

All 47 county executives got the qualified audit opinion. This is for the first time that there is no county executive with an Adverse or Disclaimer opinion. On the part of the County Assemblies, eight assemblies got an Unqualified opinion including Kwale, Kitui, Turkana, West Pokot, Trans Nzoia, Kericho, Bomet and Bungoma. Homa Bay and Migori County Assemblies got Adverse opinion, meaning the Auditor found evidence that their reports are not true and correct. The rest of the assemblies received Qualified opinions.

E-citizen revenue system

From the foregoing, does it mean then that managers at the two levels of government did an exemplary job in managing public resources entrusted to them? Are there any reasons for citizens to worry?

As they say, the devil is always in the details. By their nature, external audit outcomes do not guarantee that mischief did not happen in the course the application of public funds. Besides the overall opinion, the auditor details reasons and evidence that lead to their conclusions. It is in these details where the auditor points problems that the users of the report must look at to understand her findings and relevant course of action to strengthen governance and accountability.

One of the emphatic issues raised by the auditor is the lack of resolute action on audit queries that have consistently been recurring on her reports. This places the responsibility on the doorstep of legislators as the weakest link in our public resource management. Simply put, the men and women to whom we have delegated the burden of oversight are our biggest problem.

This is evidenced by glaring queries in the National Government Constituency Development Funds where they have direct interest. As the electorate, we also bear part of the blame because of the quality of people we elect into these offices.

A second distinctive problem emerging from the 2023/24 financial report is non-compliance with the One-third (1/3) salary deduction limit under the Employment Act. It is worth noting that across both levels of government, the auditor has flagged it as one of the bases of Qualifying her opinions. This speaks directly the destructive tax burden that the Housing Levy and contributions towards the Social Health Insurance Fund have placed on public officers. Administrators in public entities have been left with no choice but to breach this requirement in the labour Act in order to comply with the new levy laws.

The final matter of great public interest raised by the auditor is the E-citizen revenue system. This is one of the only two accounts the Auditor returned an Adverse Opinion verdict. This must worry each one of us, given that millions in service charges are collected through the system based on Executive order that lacks sound legal backing under the Public Finance Management laws.

As I pen off, I presume by now you are also aware the Auditor has flagged about Sh32 million loaned to underage or unborn persons by the Hustler Fund!